In today's fluctuating market landscape, making sound capital allocation decisions can feel like navigating a treacherous path. Market volatility adds another layer of difficulty, leaving many investors hesitant. However, with careful planning and a thoughtful approach, it's possible to not only survive these times but also discover potential.

A key strategy is to diversify across a range of investment vehicles. This can help mitigate your exposure to any single investment. Moreover, conducting thorough due diligence is essential. Understanding the economic indicators of potential investments can give you an edge to make more calculated decisions.

Finally, remember that investing is a ongoing process. Don't let short-term price volatility derail your long-term vision. Maintain discipline, and seek guidance from a qualified investment professional when needed.

Steering Volatile Markets: Making Informed Investment Decisions

In the dynamic landscape of financial markets, where volatility reigns supreme and uncertainty abounds, making informed investment decisions requires a calculated approach. Investors must equip themselves with a robust toolkit to reduce risk while maximizing opportunity. A thorough evaluation of market trends, economic indicators, and company fundamentals is crucial for identifying investment opportunities.

- Employing historical data can provide valuable insights into past market movements.

- Diversification, the approach of spreading investments across various asset classes, sectors, and geographies, can buffer the impact of swings.

- Staying informed about current events and their potential effect on financial markets is paramount.

By adhering to a well-defined investment approach, investors can navigate volatile market conditions with conviction and work towards achieving their long-term financial goals.

Crafting a Resilient Portfolio: Strategies for Uncertain Times

In turbulent market situations, building a resilient portfolio is paramount. A well-diversified strategy encompasses allocating assets across various asset classes such as shares, bonds, real estate, and commodities. This diversification mitigates risk by ensuring that if one asset class struggles, others may balance the losses. It's also crucial to consistently review and rebalance your portfolio to maintain your desired portfolio structure.

Furthermore, utilizing a long-term investment horizon can help weather short-term market volatility. Remember that investments tend to recover over time, and patience is key.

Evaluate alternative investments like gold or precious metals which may act as a hedge against inflation during uncertain periods. Lastly, don't hesitate to consult a qualified financial advisor who can provide customized guidance based on your financial situation.

Conquering Unpredictable Economies: Mitigating Risk and Maximizing Returns

In today's volatile marketplace, predicting the future can feel like a gamble. To survive amidst uncertainty, it's vital to adopt a strategic approach. Diversification is alternative investments during uncertainty paramount, allocating your assets across markets can mitigate the impact of downturns in any isolated area.

Periodically review your portfolio, optimizing based on evolving market trends. Remain informed by tracking financial news, and consult with professionals who can provide relevant recommendations. Remember, a flexible strategy is your best weapon in navigating the complexities of an unpredictable economy.

Navigating Investment Decisions in Volatile Markets

As markets fluctuate and economic conditions transform, establishing a robust framework for investment planning becomes paramount. Investors must adopt a disciplined approach that emphasizes both diversification and a long-term perspective. A well-structured portfolio minimizes the impact of market volatility, providing a basis for sustainable growth over time.

- Evaluate your financial goals to create a personalized investment strategy.

- Diversify your investments across asset classes to reduce risk.

- Stay informed to make informed investment decisions.

Rebalance your portfolio periodically to maintain your desired asset allocation and seize market opportunities.

Taking Control: The Power of Smart Investment Choices

Investing wisely requires more than just randomness. It demands a deep understanding of financial markets, market dynamics, and a solid grasp of investment approaches. By cultivating your financial literacy, you can make savvy decisions that align with your goals and risk tolerance.

- Start by learning yourself about various investment options, such as stocks, bonds, real estate, and mutual funds.

- Develop a clear understanding of your financial status, including your income, expenses, assets, and liabilities.

- Define your investment goals and willingness to risk. Are you seeking steady returns?

- Diversify your portfolio to mitigate risk. Don't put all your eggs in one basket.

- Regularly review your investments and make rebalances as needed based on market conditions and your evolving goals.

Remember, investing is a continual learning experience. Stay informed, be patient, and cultivate a disciplined approach to achieve your financial aspirations.

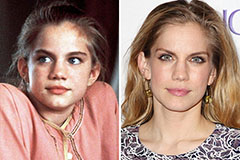

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!